Explore Our Courses

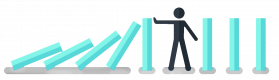

Planning and Risk Assessment

14 HoursFixed Assets Management and Control

14 HoursProject Risk Management

7 HoursLast Updated:

Testimonials(2)

workshops, open discussion

Renata Ostrowska - BFF Polska S.A.

Course - Planning and Risk Assessment

Hakan was very enthusiastic and knowledgeable

Hugo Perez - DENS Solutions

Course - Project Risk Management

Upcoming Courses

Other regions in the US

OnlineAlabama Birmingham MontgomeryArizona Phoenix TucsonArkansas Fayetteville Fort Smith Little RockCalifornia Los Angeles Sacramento San Diego San Francisco San Francisco Bay AreaColorado DenverConnecticut BridgeportDelaware DoverDistrict of Columbia Washington D.C.Florida Miami TampaGeorgia Atlanta Augusta SavannahHawaiiIdaho BoiseIllinois Chicago SpringfieldIndiana Fort Wayne IndianapolisIowa Cedar Rapids Des MoinesKansas Kansas City TopekaKentucky Lexington LouisvilleLouisiana Baton Rouge New OrleansMaine PortlandMaryland Annapolis BaltimoreMassachusetts Boston Cambridge WorcesterMichigan Detroit Grand Rapids LansingMinnesota MinneapolisMississippi Gulfport JacksonMissouri Jefferson City St. LouisMontana Billings HelenaNebraska Lincoln OmahaNevada Carson City RenoNew Hampshire Concord ManchesterNew Jersey Jersey City Newark TrentonNew Mexico Albuquerque Santa FeNew York Albany Buffalo New York CityNorth Carolina Charlotte Durham RaleighNorth Dakota Bismarck FargoOhio Cincinnati Cleveland ColumbusOklahoma Oklahoma City TulsaOregon Eugene SalemPennsylvania HarrisburgPhiladelphia PittsburghRhode Island ProvidenceSouth Carolina Charleston ColumbiaSouth Dakota Pierre Sioux FallsTennessee Knoxville Memphis NashvilleTexas Austin Dallas Houston San AntonioUtah Provo Salt Lake CityVermont Burlington MontpelierVirginia Richmond Virginia BeachWashington Olympia Seattle SeattleWest Virginia MorgantownWisconsin Madison MilwaukeeWyoming Casper Cheyenne

Other Countries

These courses are also available in other countries

Online Risk Management courses, Weekend Risk Management courses, Evening Risk Management training, Risk Management boot camp, Risk Management instructor-led, Weekend Risk Management training, Evening Risk Management courses, Risk Management coaching, Risk Management instructor, Risk Management trainer, Risk Management training courses, Risk Management classes, Risk Management on-site, Risk Management private courses, Risk Management one on one training